Why Buy AI Stocks Now?

Artificial Intelligence (AI) is no longer just a buzzword—it’s transforming entire industries, from healthcare to finance to self-driving cars. Investors worldwide are rushing to buy AI stocks, seeing them as the next big growth opportunity after the dot-com and smartphone revolutions.

According to PwC, AI could contribute $15.7 trillion to the global economy by 2030. That makes AI stocks one of the hottest long-term investment opportunities in today’s market.

If you’re wondering whether you should invest, which stocks to choose, and how to manage risks, this guide will walk you through everything you need to know.

What Are AI Stocks?

AI stocks are shares of companies that develop, use, or benefit significantly from Artificial Intelligence technologies. These can include:

- Tech giants building AI tools (Google, Microsoft).

- Chipmakers powering AI computing (NVIDIA, AMD).

- AI-driven platforms (Palantir, C3.ai).

- Industries using AI for automation, healthcare, or autonomous driving (Tesla, Amazon).

When you buy AI stocks, you’re essentially betting that these companies will grow as AI adoption accelerates.

Why Should You Buy AI Stocks in 2025?

Unstoppable Growth Trend – AI is integrated into almost every sector.

High Demand for AI Chips & Cloud – NVIDIA, AMD, and cloud providers are thriving.

Government & Corporate Adoption – AI investment is a top priority worldwide.

Diversified Applications – From healthcare to finance, AI is everywhere.

Potential for Long-Term Wealth Creation – AI is still in its early growth phase.

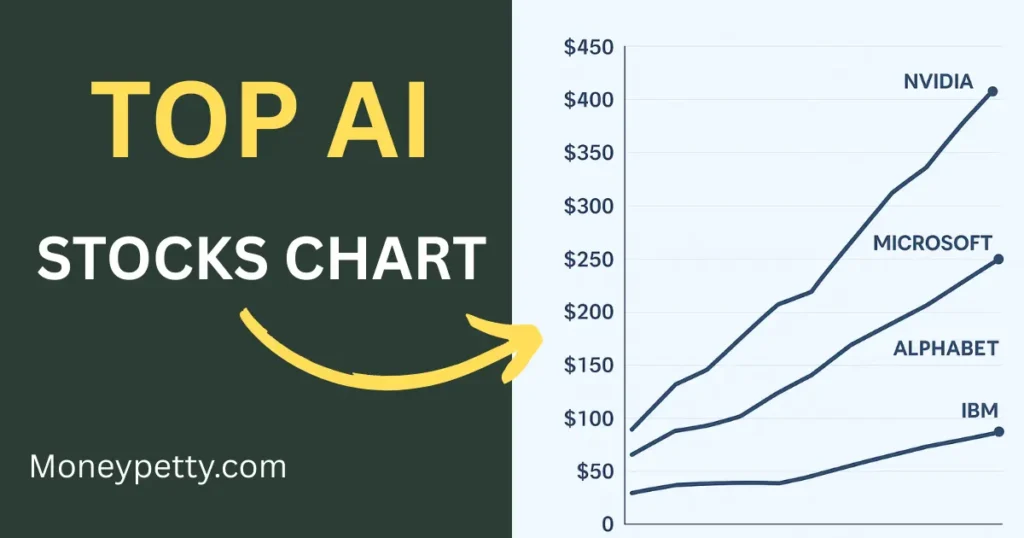

Top AI Stocks to Buy in 2025

Here are some of the best AI stocks investors are watching:

1. NVIDIA (NVDA)

Leading supplier of GPUs for AI training.

Revenue skyrocketed due to AI demand.

Considered the backbone of AI infrastructure.

2. Microsoft (MSFT)

Major investor in OpenAI (creator of ChatGPT).

Integrating AI into Office, Azure, and Bing.

Strong balance sheet and steady dividends.

3. Alphabet (GOOGL)

Google’s AI arm, DeepMind, is a global leader.

AI-powered tools like Google Bard and cloud services.

Strong ecosystem for AI innovation.

4. Amazon (AMZN)

AI in e-commerce, AWS cloud, and Alexa.

Expanding AI-powered logistics and automation.

Leader in cloud services with strong AI integration.

5. Tesla (TSLA)

AI-driven self-driving technology.

Uses AI for robotics, manufacturing, and energy storage.

Long-term potential in autonomous mobility.

6. Palantir Technologies (PLTR)

Provides AI-driven data analytics for government and businesses.

Recently launched Palantir AIP (Artificial Intelligence Platform).

7. C3.ai (AI)

Pure-play AI company.

Focus on enterprise AI software solutions.

How to Buy AI Stocks Step-by-Step

Choose a Brokerage Platform – (e.g., Robinhood, Fidelity, E*TRADE, or Interactive Brokers).

Open an Account – Provide KYC details and fund your account.

Research AI Stocks – Look at fundamentals, earnings, and AI adoption.

Decide Investment Amount – Never risk more than you can afford to lose.

Buy Shares or ETFs – Direct stocks or diversified AI ETFs.

Monitor & Adjust – Stay updated on market news and company performance.

AI ETFs: An Alternative to Buying Individual Stocks

If you don’t want to pick single companies, AI ETFs provide exposure to multiple AI stocks.

Popular AI ETFs include:

Global X Robotics & Artificial Intelligence ETF (BOTZ)

iShares Robotics and Artificial Intelligence ETF (IRBO)

ARK Autonomous Technology & Robotics ETF (ARKQ)

These funds spread your risk while letting you benefit from the AI boom.

Risks of Buying AI Stocks

While AI stocks are promising, they come with risks:

Volatility – Prices swing heavily due to hype cycles.

Competition – Many companies fighting for market share.

Overvaluation – Some AI stocks trade at extremely high P/E ratios.

Regulation Risks – Governments may impose rules on AI usage.

👉 Tip: Diversify your portfolio to reduce risks.

Strategies for Investing in AI Stocks

Long-Term Holding (Buy & Hold): Hold leading AI stocks for 5–10 years.

Dollar-Cost Averaging (DCA): Invest a fixed amount regularly.

Diversification: Mix AI stocks with ETFs and other industries.

Growth & Value Balance: Don’t just buy high-flyers, look for stable players too.

Expert Tips for AI Stock Investors

- Follow earnings reports and AI adoption news.

- Track partnerships & acquisitions in the AI sector.

- Be cautious of AI penny stocks with weak fundamentals.

- Always keep a long-term perspective—AI is still developing.

FAQs :- About Buying AI Stocks

Q1. Is it a good time to buy AI stocks in 2025?

Yes, AI adoption is accelerating across industries, making 2025 an attractive entry point. However, always assess risks before investing.

Q2. Which AI stock is best for beginners?

NVIDIA (NVDA), Microsoft (MSFT), and Alphabet (GOOGL) are strong options due to stability and growth.

Q3. Are AI stocks overvalued?

Some are. Many trade at high valuations, but strong earnings growth may justify them long-term.

Q4. Can I invest in AI stocks with little money?

Yes, platforms like Robinhood allow fractional share investing.

Q5. What’s safer: AI stocks or AI ETFs?

AI ETFs are safer since they spread risk across multiple companies.

Q6. How long should I hold AI stocks?

Ideally, at least 5–10 years to benefit from the AI revolution.

Conclusion: Should You Buy AI Stocks?

Buying AI stocks in 2025 is one of the smartest moves investors can consider. With AI set to revolutionize industries and power global economic growth, top companies like NVIDIA, Microsoft, and Alphabet are positioned for massive upside.

That said, risks remain, and investors should always balance excitement with caution. By diversifying into AI leaders, AI ETFs, and long-term strategies, you can secure your spot in the AI-driven future of investing.